e-ISSN:2320-1215 p-ISSN: 2322-0112

e-ISSN:2320-1215 p-ISSN: 2322-0112

1Department of Pharmacy, Lebanese University, Beirut, Lebanon

2Department of Research, Psychiatric Hospital of the Cross, P.O. Box 60096, Jal El-dib, Lebanon

Received Date: June 05, 2017 Accepted Date: July 25, 2017 Published Date: July 30, 2017

Visit for more related articles at Research & Reviews in Pharmacy and Pharmaceutical Sciences

Objective: To describe the market share of importers, manufacturers and countries of origin of prescribed drugs in Lebanon; and to examine the effects of the price reductions enforced by the ministry of health on highly prescribed drugs.

Methods: 1326 medical prescriptions were collected from 3 different pharmacies in Mount Lebanon during the period July 2015 and February 2017. Costs were analyzed using 16 lists of drug prices from November 2014 to March 2017 provided by the ministry of public health. We also included the composition and therapeutic class of each medication. We used a one-tailed Z-test in order to check the validity of the claim that the reduction in prices enforced by the ministry of health affected highly prescribed drugs more than others on the total population of drugs prescribed.

Results: Out of 4265 drugs in our prescriptions, 19.5% were manufactured in Lebanon and 61.9% imported from European countries whose manufacturers dominated the top 10 manufacturers count. Mersaco topped the importers list July with 18.9% market share followed by Phenicia (10.8%). The most commonly prescribed drug classes in the sample were anti-infectives (24% of all drugs), followed by pain and inflammation agents (17.6%).

The mean drop in prices between November 2, 2014 and March 21, 2017 is larger for highly prescribed drugs than for others (p-value<0.00001), with a 99.8% confidence interval of (17.6%, 19.3%).

Conclusion: The cost of medication decreased in the last 2.5 years, however we still need to investigate the effects of this change on community pharmacists and the patients.

Market share, Cost, Price, Community pharmacy, Lebanon

Pricing of a pharmaceutical drug is determined by the value it brings to patients and the competitive environment it enters. If it is priced too high, physicians and payers may shy away from prescribing or reimbursing it because they might perceive that the drug provides too little benefit for the added cost. Ironically, if a new drug is priced at a discount to an existing therapy, it might also be avoided because the lower price might imply inferiority [1].

Price changes of drugs certainly affect the market from manufacturers to agents and pharmacies to consumers. In Lebanon, it is practically hard to quantify the change since there are many variables to take into consideration: the regular recall [2] and addition of new drugs, the exchange rate determined in the currency market and some reductions in prices [3] enforced by the Lebanese ministry of public health (MOPH) through changes in some of the laws and regulations [4], which in turn affected the availability of branded and generic medicines [5], but mainly the problem of which drugs are prescribed by physicians and with what proportions is by far the most interesting and hardest to quantify.

A survey conducted by the MOPH in 2004 showed that almost all the surveyed medicines (total of 32) are priced higher than the international reference price and innovator brands are possibly used more extensively as there are no incentives to prescribe and sell generic equivalents [6]. A later MOPH survey in 2013 concluded that prices of lowest priced generics increased, but prices of originator brands were similar and that medicines were more affordable in 2013 compared to 2004 [7]. Still, how much these drugs were used or prescribed is left unanswered, and this information is critical if we want to analyze the market.

The MOPH regulates pharmacy practice, sets the price and the percentage of profits of all medicines under article 80. In 2014, the ministry changed the bracket of profit for drugs priced more than $200 from 18.5% to only $80 regardless of the original cost [8], a change that left pharmacists financially unsatisfied [9].

Introduced in July 2015, the Unified Medical Prescription (UMP) has been a positive step for the healthcare system in Lebanon [10], since it is one component of a broader policy that seeks to lessen the burden of health costs for citizens. Following this law, the medical prescription is made of 3 carbon copies: one for the physician, one for the pharmacist and one for the patient. Pharmacists began collecting copies of these prescriptions, building archives of valuable information.

The objective of the study is to answer the following questions:

Which countries/manufacturers/importers have the largest market share in Lebanon?

What are the most prescribed drugs/pharmaceutical classes/active ingredients?

How did the public price of drugs change in the last few years? And did the reduction in prices enforced by the ministry of health affect highly prescribed drugs more than others?

Data Collection

A sample of 1326 medical prescriptions was collected from 3 different pharmacies in Mount Lebanon during the period July 2015 and February 2017. All information was entered manually with the help of a piece of software written in Python. The names of the prescribing doctors were not entered, neither the date of the prescription nor the posology. The patients’ names were only entered to ensure that the same treatment was not entered twice; from that step, onward the patients’ names were discarded.

Sixteen MOPH public price lists were used from November 2014 to March 2017, downloaded from the ministry of health’s website. Additional features created are composition [11] and therapeutic class [12,13] of each drug in the sample. All prices were converted from Lebanese pounds to US dollars using the 24/5/2017 exchange rate of 1$=1511.32 L.

Tools

The analysis was carried out using Python version 3.5 through the Anaconda distribution. The main libraries used were Numpy, Pandas, Matplotlib and Seaborn.

Price Analysis

To analyze price changes between November 2, 2014 and March 21, 2017, we took into consideration drugs with public price less than 430 USD. We did this for the following 2 reasons:

Our sample included only 4 drugs with price more than 430 USD, and this cannot be considered representative of this group of expensive drugs. Furthermore, these are generally distributed free of charge from MOPH dispensing center, therefore not present in pharmacy prescriptions.

Because the distribution of drug prices is right skewed, we had to eliminate outliers whose price change can affect the mean dramatically.

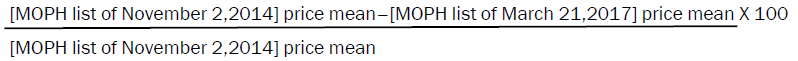

So, our sample was reduced from 4265 to 4261 drugs. Calculating the mean price changes between November 2, 2014 and March 21, 2017 directly from the MOPH price lists, we found the mean drop to be 4.1%. This number was calculated in the following way (also ignoring drugs with price more than 430$):

(MOPH list of November 2, 2014) price mean=34.64$

(MOPH list of March 21, 2017) price mean=33.26$

MOPH list mean price drop =

MOPH list mean price drop=4.1%.

In order to compare the mean price change of prescribed drugs, from 2014 to 2017, and because these 2 groups are not independent (knowing the price of a certain drug in 2014 tells us something about its price in 2017), we did the inference on a new variable which we called “price drop”, created in the following way:

For each drug find its “latest price” (if it’s not present in the price list of March 21, 2017 (for example if the drug was recalled) search for its price in a list with the closest date (List of 23 February 2017))

For each drug find its “oldest price” (if it’s not present in the price list of November 2, 2014 (for example if the drug was not yet available) search for its price in a list with the closest date (List of 3 January 2015))

For each drug calculate the following percentage=oldest price-latest price/ oldest price X100

This list of numbers constitutes the new variable “price drop”. The list average is the sample’s mean price drop, which we will use to infer the population’s mean price drop.

The null hypothesis (H0) states that the population’s mean price drop is equal to the MOPH list mean price drop (the price reductions enforced by MOPH did not affect prescribed drugs more than others). The alternative hypothesis (HA) states that the population’s mean price drop is larger than the MOPH list mean price drop. We checked the conditions for the Central Limit Theorem (CLT):

Independence: Drugs in our sample are taken at random from the total population of prescribed drugs.

Sample size ≥ 30 for a not at all to moderately skewed sample: Condition satisfied by looking at the sample distribution of prices drop which was not extremely skewed.

10% condition: Our sample is drawn without replacement as the same drug taken by the same person is not considered twice, but the sample size is certainly no more than 10% of the total population of drugs taken by all individuals (in Mount Lebanon).

Statistical Analysis

Because the all CLT conditions were satisfied, we can use a one tailed Z-test to do the inference. A p-value<0.05 was considered statistically significant.

Descriptive Analysis

In this study, 1326 prescriptions were randomly selected for analysis. The average number of drugs per prescription was 3.2 (SD=2.1). Our sample contained a total of 4265 drugs, of which 945 are unique brand names, out of a population of 5685 drugs in the MOPH price list of March 21, 2017. 50% of prescribed drugs had a public price less than 6.7 USD.

Countries

Lebanon was found to be the leading country in the sample with 19.5% of prescribed drugs manufactured in Lebanon, knowing that 21.1% of drugs available in the Lebanese market are manufactured locally. The absence of Arab countries in the top 10 is noteworthy (Figure 1).

European countries had a total sample share of 61.9%, with France (14.3%), Spain (9.1%) and Germany (6.5%) leading this group (Figure 2).

Manufacturers

Looking at the top 10 manufacturers in the sample and in the price list of March 21, 2017, the results demonstrated that Sanofi was the top manufacturer in the sample (3.4%), followed by Mediphar laboratories and Normon SA (3.2% each) and SmithKline Beecham (3%) (Figure 3), while Benta SAL was on top in the MOPH list (3.3%), followed by Mediphar Laboratories (2.6%) and Julphar (2.1%) respectively (Figure 4).

Importers

Looking at the top 10 agents in the sample (Figure 5), we see that the top 9 had their share increased in the sample with respect to that in the price list of March 2017. Mersaco has the highest records overall, with 18.9% market share (in the prescriptions) and 12.2% of drugs available in Lebanon imported by this agent. Phenicia came in second with the largest gap between their sample share (10.8%) and their MOPH list share (2%) which can be considered a sign of efficient marketing.

Not surprisingly the bottom 10 agents in the sample had their share decreased with respect to that in the price list. Macromed made a surprising appearance in the bottom 10, importing 2.2% of drugs available in the market and having a share of only 0.05% in the prescriptions.

Most prescribed drugs in the sample

The most commonly prescribed classes in the sample were anti-infectives (24% of all drugs), followed by pain and inflammation agents (17.6%).

The top 10 prescribed brand names in the sample are presented in Figure 6, with Augmentin® (Amoxicillin–Clavulanic acid) 1 g tablets leading with a presence in 3% of the total prescriptions, followed by Gastrimut® (omeprazole) (2.02%), Panadol® (paracetamol) (1.13%), Normix® (rifaximin) (1.1%) and Nexium® (esomeprazole) 40 mg (1.06%) respectively.

Augmentin 1 G: Amoxicillin, Clavulanic acid-Tablets (1 g)

Gastrimut: Omeprazole-Tablets (20 mg)

Panadol B&I: Paracetamol-Suspension for infants (120 mg/5 ml)

Normix Tab: Rifaximin-Tablets (200 mg)

Nexium 40 mg: Esomeprazole-Tablets (40 mg)

Tavanic 500 mg: Levofloxacin-Tablets (500 mg)

Profinal Syp: Ibuprofen-Suspension (100 mg/5 ml)

Nasonex: Mometasone-Nasal spray (0.05%)

Panadol: Paracetamol-Tablets (500 mg)

Motilium: Domperidone-Tablets (10 mg)

In the antibiotic class, 34.4% of prescribed antibiotics were beta-lactams, 21.2% quinolones and only 14.4% were of the cephalosporin class. The median price in this category was 8.5 USD.

Omeprazole was the most commonly prescribed proton pump inhibitor (PPI) (52.8%), followed by esomeprazole (26.1%) and rabeprazole (12.7%). The median price of a PPI was 9.5 USD.

Paracetamol was the most prescribed pain/inflammation agent (present in 24.1% of prescriptions in this class), followed by diclofenac (15.7%) and ibuprofen (9.9%). The median price in this category was 4.1 USD.

The calculation of the sample mean price drop showed that the sample mean price drop (18.44%) was certainly larger than the MOPH list mean price drop (4.1%).

To infer the population, mean price drop, we calculated the Z-statistic and found it to be 52.9, making the pvalue< 0.00001. Therefore, we concluded that the data provides convincing evidence that the population mean drop in prices between November 2, 2014 and March 21, 2017 is larger than that of MOPH price list. The 99.8% Confidence Interval was (17.6%, 19.3%), meaning we are 99.8% confident that the average price drop (from November 2, 2014 to March 21, 2017) of the total population of prescribed drugs is somewhere around 17.6% and 19.3%.

In this study, 1326 prescriptions were randomly selected for analysis. The average number of drugs per prescription was 3.2 (SD=2.1), the most commonly prescribed drugs were anti-infectives (24% of all drugs), followed by pain and inflammation agents (17.6%).

Drugs in our sample were mostly manufactured in Lebanon and Europe (81.4%), with the latter having a larger share in the sample than that in MOPH list of March 2017, while Asia’s share decreased. When comparing manufacturers’ shares between the sample and the price list, we also noted that European manufacturers entered the top 10 in the sample and took the place of Arab ones. It is no surprise that big companies sell better, since some may spend money on marketing up to 19 times that on drug research [14].

A study in 2015 [15] showed that cephalosporins were the most prescribed antibiotic class (82% of total antibiotic prescriptions), in opposite to our results. However, these numbers are by no way representative of the total antibiotic usage, for that we have to take into consideration the dispensed antibiotics without medical prescription, which is a common practice in Lebanon, particularly in lower socioeconomic areas [16]. Moreover, similar to a previous study [17] , we found that omeprazole was the most prescribed proton pump inhibitor, followed by esomeprazole then rabeprazole.

The reduction of prices enforced by the ministry of health affected highly prescribed drugs more than others. The average drop in the cost of all prescribed drugs (in Mount Lebanon) from 2 November 2014 to 21 March 2017 was between 17% and 19.3%. This downward trend is not surprising. In late 2016, a study showed that the total number of monthly sales and profit in pharmacies in Lebanon decreased significantly in the last 10 years [9] when most community pharmacy owners were financially satisfied [18].This problem, added to the problem of poor public perception [19] is making the situation very hard for community pharmacists nowadays.

The downward sloping involved the total expenditure on health in Lebanon as well, that dropped from 12.6% of Gross Domestic Product (GDP) in 1995 to 6.4% of GDP in 2014, unlike the expenditure of all countries combined that went up from 8.5% to 9.9% of GDP [20]. From another perspective, it has been shown in the US that when the price of medicine goes up the quality of life of consumers who need the medicine decreases [21,22] .Patients who pay for high cost medicine are more likely to change their lifestyle to spend less money on family needs and entertainment [21], with an increased risk of going into debt [21]. High drug prices can also prevent people from saving for retirement [21]. Therefore, we might argue that we have a good reason to believe that lowered medication costs can lead to patients having, in general, a better standard of living.

Our results cannot be generalized since the prescriptions were collected from 3 pharmacies in Mount Lebanon only. Further studies are needed taking a bigger sample from all governorates in Lebanon. Since the patient’s name was not always present or readable on the prescription copies we used, we could not follow the same patient over time, nor could we analyze the posology and duration of the treatment for the same reasons.

One assumption we made concerning the price drop between 2014 and 2017, was that the prescribing trend did not change from 2014 through 2017. This is probably not precise since a drop in the price of a certain brand may cause doctors to prescribe it more, which makes the mean price drop even higher than we calculated.

In conclusion, the cost of medication decreased in the last 2.5 years. In Mount Lebanon, the drop was between 17% and 19.3%. Further studies are needed to quantify the change in all the country and assess its impact of the community pharmacist and the patient.

We thank Dr. Chirine Tadros and Dr. Salem Chaccour for providing us with the data and for their general support.

The authors have nothing to disclose.

The authors received no funding for this study.